Investing For The Long-term (Retirement)

Investment Vehicles in Portugal

8 min read.

In this chapter, we’ll review the main investment vehicles on offer in Portugal according to our Investment Approach (discussed in an earlier chapter). These are:

- Plano Poupança Reforma (PPR)

- Investment Funds

- ETFs

The goal is to choose the vehicle that best fits our preferences, defined by our assessment criteria discussed above. Do a quick review here.

Plano Poupança Reforma (PPR)

A quick overview: PPRs are managed by teams of financial experts who will invest their client’s money according to a pre-defined investment strategy. They are long-term investment vehicles, and as such, they impose strict rules and penalties on early withdrawals. On the other hand, since the government wants to incentivize people to save for their retirement, PPRs benefits from an attractive tax regime that the other investment vehicles don’t. Also, no commission is charged for funding your PPR.

Tax Regime

Let’s start with this tax regime. PPRs offer two tax benefits. First, your investments in a PPR are tax-deductible in the IRS, as described in the following table.

| Age | Deduction | Limit | Investment for the maximum deduction |

|---|---|---|---|

| Younger than 35 | 20% | 400 € | 2.000 € |

| 35 to 50 years old | 20% | 350 € | 1.750 € |

| Older than 50 | 20% | 300 € | 1.500 € |

This means that, if you’re under 35 and invest 2.000€ on your PPR in a single year, you’ll pay 400 € less in your IRS. That’s free money!

Second, when you withdraw your savings, the tax on Capital Gains (Imposto sobre as Mais-Valias) is only 8% instead of the regular 28%. That means that, at retirement age, you’ll take home 20% more of your total capital increase than the capital gains you would get by investing under other tax regimes. That’s pretty big!

But there’s a catch. These tax breaks work as compensation for the fact that, in such plans, withdrawal can only be done under specific conditions, and often subject to heavy penalties. In other words, it’s both difficult and costly to withdraw your money before retirement. So you should only consider investing under a PPR if you’re willing to lock this money away and only retrieve it on your retirement.

But that’s our intention right? We’re investing for the long-term, to withdraw only at retirement anyway, so a PPR’s constraints on early withdrawals shouldn’t be a deal-breaker.

Active Management

The biggest deal-breaker is the fact that, under a PPR, you’re handing your money to be invested by someone else. It’s the active management we talked about in the previous chapter. You won’t be able to choose the assets you own, and it’s statistically unlikely that the PPR will consistently outperform the general market, due to the higher fees they charge their clients and the expenses they pay with commissions and taxes from trading too much.

From what I saw, PPRs (as with any other actively-managed funds) charge between 0,5% and 1,5% higher annual fees on your total equity than the tracker funds that you’ll invest in if you’re managing your investments on your own. That alone will offset at least part of the tax benefits they offer.

Employer Match To Your Investments

So, are these drawbacks a deal-breaker for you? Before you decide, please consider one last item that can influence your investment returns. That item is whether your employer contributes towards your retirement plan.

From what I know, depending on the country it can be common practice for employers to offer such long-term savings plans like PPRs as part of their compensation package. To motivate investment in these savings plans, employers have schemes where they match, in total or partially, your investment in the plan. So for example, if your employer matches your investment by 50%, for every 100€ you invest in your PPR, you’re actually putting in 150€. Again, that’s free money, and it can dramatically improve your expected rate of return.

Since my employer doesn’t offer any such benefits and because I believe that PPRs’ may still underperform regular tracker funds despite their tax benefits, I decided to move on to look for what were the alternatives.

Investment Funds

Although there are passively-managed Investment Funds, most Investment Funds offered by financial institutions are, similarly to a PPR, actively-managed. No commissions are charged for funding your Investment Fund. The main difference between PPRs and Investment Funds is the fact that Investment Funds are not explicitly a long-term investment vehicle. You can withdraw your money in total or partially from an Investment Fund whenever you want, without having to meet any conditions or paying any penalty. This naturally comes with the implication that there are no tax benefits from investing in an Investment Fund.

Therefore, Investment Funds are attractive to investors who want to put their money in the stock market for the short/medium-term, but have it actively managed by fund managers. We’re investing for the long term, so the freedom to withdraw your money is of no great value to us, and our investment strategy is to simply invest in the general market through a passively-managed tracker fund. Investment Funds are not for us then.

ETFs

ETF stands for Exchange-Traded Funds. As the name suggests, ETFs are basically Investment Funds that are traded in the stock market, just like any stock. This means that ETFs and Investment Funds share all characteristics, except for two: most ETFs are passively-managed, and your broker charges commissions when you buy and sell ETFs.

A Summary: Comparing PPR, Investment Funds and ETFs and Why I Chose ETFs

To decide which vehicle is best for us, let’s quickly review where they differ.

| PPR | Investment Funds | ETFs | |

| Management | Active | Most are active | Most are passive |

| Early withdrawals | Difficult and expensive | No restriction | No restriction |

| Employer matching your contributions | Possible | None | None |

| Expenses | |||

| Annual Management Fees | 0,75% – 2% | 0,75% – 2% | Up to 0,20% |

| Commission on trading (buy or sell) | No | No | Up to 16€ per ETF bought.* |

| Taxes | |||

| Capital Gains Tax | 8% | 28% | 28% |

| IRS Deduction | Up to 400 € | None | None |

* Actually, the commission structure of buying assets traded in the stock market is complex, but we’ll probably keep our expenses at 16€ per ETF maximum.

Considering each vehicles’ pros and cons, I decided to invest in ETFs. They are the only passively-managed investment option, which is important because:

- Then it is me who decides which assets I hold in my portfolio, with my specific asset allocation and diversification.

- They entail significantly lower annual fees, which compensate for the commission on trading.

- I don’t expect actively-managed funds to be able to beat the market’s performance. On the contrary, I expect my returns to be higher by simply investing in the market through market-tracker-funds than the fund manager’s returns when they try to pick outstanding stocks.

How about combining ETFs with a PPR?

Let’s take a look at PPRs’ IRS tax deduction benefits again.

| Age | Deduction | Limit | Investment for the maximum deduction |

|---|---|---|---|

| Younger than 35 | 20% | 400 € | 2.000 € |

| 35 to 50 years old | 20% | 350 € | 1.750 € |

| Older than 50 | 20% | 300 € | 1.500 € |

So you’re saying that, until I’m 35 years old, if I invest 2.000 € a year in my PPR I get a 400 € tax-break in my IRS? That’s incredible! That’s free money! If you just put into your PPR the amount to get the maximum tax deduction, you’re literally paid 20% of your investment. You won’t get an immediate 20% guaranteed return rate on your yearly investment anywhere else.

But the thing is: the 20% return rate only applies to the first year those 2.000 € are invested. After that, those 2.000 € are invested by the PPR fund manager, earning the return he can deliver (which we’ve seen should be lower than the return from a simple tracker-fund). Also, your whole savings are being charged a higher annual management fee every single year until your retirement.

Still, it’s a thought worth exploring. So let’s make a quick exercise. Let’s see how a PPR’s annual return rate must compare to the annual return rate of a self-investment (on ETFs) to make it worth it to add the PPR to our investment structure. Let’s assume that:

- We’re 27 years old and we’re investing until we’re 65.

- We invest in your PPR the exact amount for maximum deduction every year.

- We use the IRS deduction to self-invest.

- The PPR has an Annual Management Fee of 0,75% while our ETFs charge 0,20%.

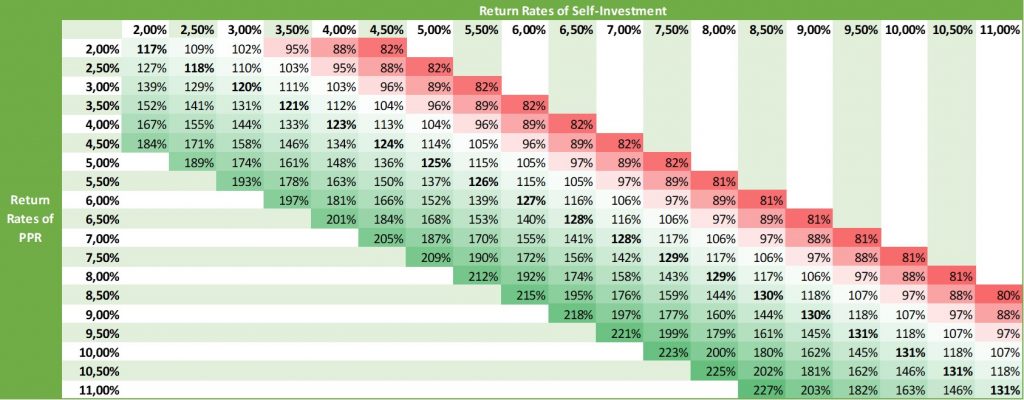

The heat-map below shows how the total returns generated by combining a PPR with self-investment compare to the alternative of self-investing the amount placed in the PPR, on several combinations of average annual return rates of the PPR and of the self-investment.

To read the heat-map, take this example: if both the PPR and the self-investment have an average annual return rate of 6%, then combining the PPR with self-investment on the terms listed above generates a total return-on-investment 27% higher than the alternative of self-investing the amount placed in the PPR.

You can download the Excel used for the exercise above here: ppr-tax-deduction.xlsx.

Analyzing the heat-map, we may conclude that, if the PPR can match our self-investment performance, the amount invested in the PPR (if exactly the amount required to get the maximum IRS deduction) generates a higher return of 25 to 30% than the alternative of self-investing that amount. In fact, the PPR has to under-perform our self-investment somewhere between 1% and 1,5% for the tax benefits to be undermined by the PPR’s lower performance and higher Annual Management Fee.

So what will I do? For now, I haven’t opened a PPR. I’m not entirely convinced that it will be beneficial. I’ll look for PPRs on offer though, and if I find one that is very similar to my investment strategy, I’ll consider opening one. But I don’t think I’ll find one that will give me confidence to be honest.